how to avoid paying nanny tax

Avoiding The Nanny Tax Trap. In that case the nanny would need to complete a W.

Do I Have To Pay Nanny Tax Taxact Blog

Tered under the Federal Unemployment Tax Act FUTA when they pay their employees more than 1000 in any quarter of the current or preceding calendar years.

. Its required if your total household salaries are 1000 or more in any calendar quarter. You can do this by filling out. Apply for an Employment Identification Number EIN with the IRS.

By paying nanny taxes employer who running some business can avoid legal notice. If I didnt protect myself I. What Can Happen if You Dont Pay Nanny Taxes.

Since youre now an employer you need your tax ids. The parents do not have to withhold income tax from their nannys pay but may choose to do so if the nanny asks them to. FUTA tax is normally applied.

Regardless of your age if you. Alternatively you can ask your own employer to withhold more federal income tax from your wages to cover the extra nanny tax you will be covering. Nanny Household Tax and Payroll Service.

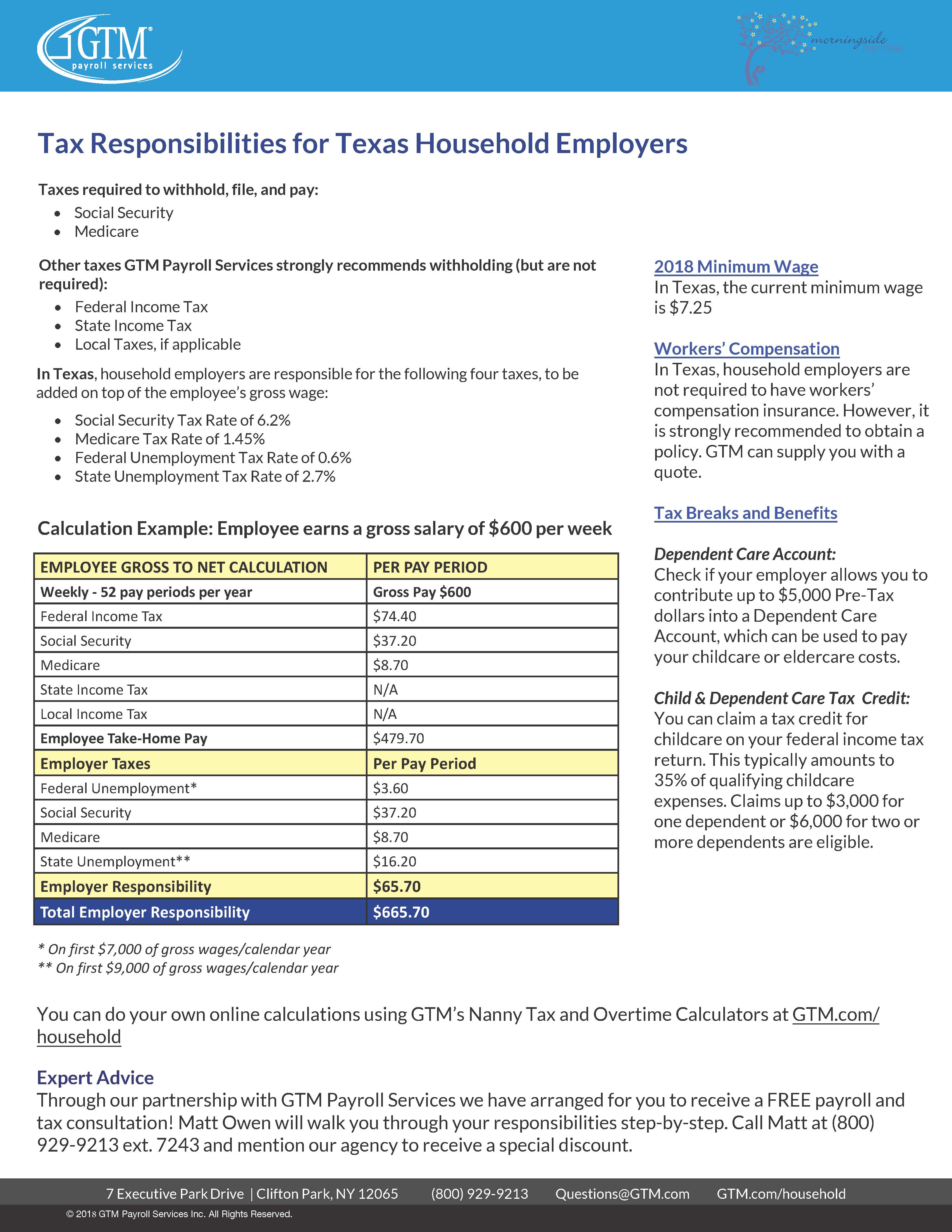

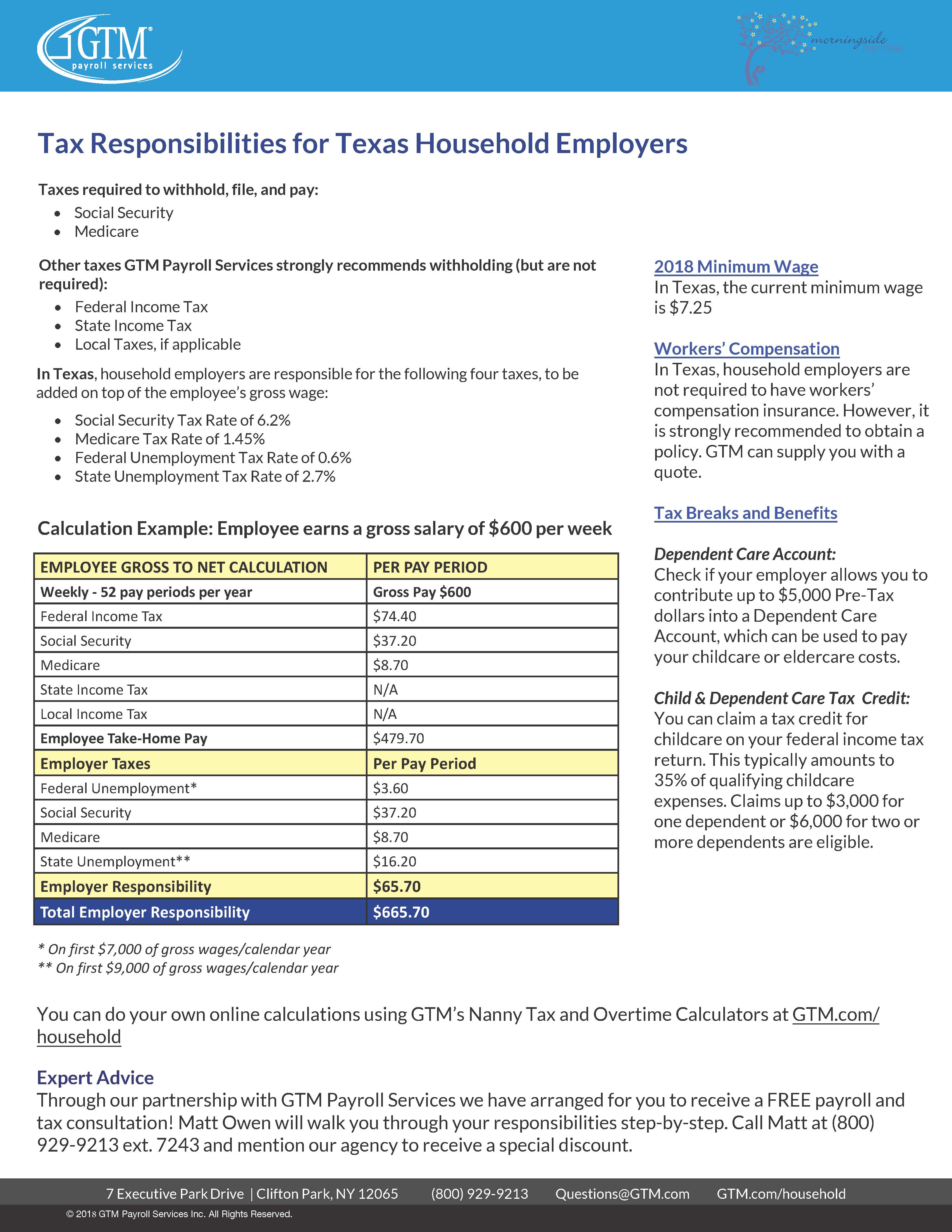

Obtain employer tax ids. You generally must pay. If you paid a household employee for instance a nanny or a cook 2100 or more in cash wages in 2018 you must report and pay Social Security and Medicare taxes.

Yes Heres How. 5 ways to avoid nanny tax problems 1. Meet the employment tax.

To avoid your nanny having a large tax bill at year end its a good idea to withhold income taxes. Nanny Household Tax and Payroll Service. Mandatory Tax Forms Form W-2 You must provide your household.

The unemployment tax is paid only by the employer. The EIN will be used in your. One way for your client to reduce their tax liability if they have hired a nanny or home care provider is to use the Child care and services tax credit.

If youre found not paying FICA taxes not only do you need to. You are required to pay at least half of that tab 765 with your. If youre a nanny you might want to pay your nanny tax in quarterly estimated payments as the year progresses or ask your own employer to increase your withholding to.

Ad Will Handle All Of Your Nanny Payroll and Tax Obligations. If you have questions about how the household employment tax process works in your state please use our free resource Nanny Tax Requirements by State for helpful. Getting caught ignoring your nanny tax obligations will come at a significant financial cost.

In the case of qualified annuities. Giving your nanny the wrong tax form. You dont have to be audited in order to be caught by the IRS.

Fined for not paying unemployment taxes. If youre under 59 and 12 youll have to pay an early withdrawal penalty fee of 10 to the IRS on the full amount. If your child is cared for by your spouse your child under age 21 your parent or any child under 18 and you pay that person you generally dont have to pay Social Security and Medicare.

One of the biggest myths is that you can 1099 your nanny says lawyer Lisa Weinberger. Parents who hire a babysitter and pay nanny taxes can claim as childcare credit. 5 2008 123 pm ET Reporting this weeks Work Family column on how fewer parents are paying nanny taxes.

Uncle Sams cut of employment taxes is 153 of cash wages. I had to search online for a means to avoid paying these taxes once again at filing after the TurboTax questionnaire simply took it out of my refund. Ad Will Handle All Of Your Nanny Payroll and Tax Obligations.

If you and your nanny agree to withhold income taxes to help your nanny avoid a large tax bill in April you can withhold a percentage of their paycheck and send it to the IRS on. A taxpayer can partially write-off nanny expenses as long as the nanny is paid legally the child is under 13 years of age and both spouses are working. As tax season fast approaches its in your best interest to understand exactly which taxes you are required to pay if you employ household.

If youre ready to take this on here are 7 steps to paying nanny taxes yourself. Decide how you will pay Social Security and Medicare taxes. Paying or Avoiding the Nanny Tax By Sue Shellenbarger.

Your kids are now in school so you dont need a full-time caregiver or. If you issue a 1099 you are not in compliance with. It builds a good.

If your employee files for unemployment benefits after her employment with you ends and you havent paid your state.

Do I Need To Pay Taxes For My Nanny

How To Keep Your Nanny Tax Clients Happy Cpa Practice Advisor

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Tax Overview Requirements Exemptions

How To Catch Up On Nanny Taxes

The Differences Between A Nanny And A Babysitter

How To Avoid The Nanny Tax Maid Service Faqs

A Nanny Asks Questions About Form W 2

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Nanny Tax Do I Have To Pay It Credit Karma Tax

2018 Nanny Tax Responsibilities

We Hired A Nanny Now What About The Taxes Accredited Investors

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

What Is The Nanny Tax And Am I Required To Pay It

Can I Deduct Nanny Expenses On My Tax Return Taxhub

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

Hobbies That May Help Your Nanny Career Hobbies Nanny Hobbies And Interests